1. What is Modelo 720?

Modelo 720 is a mandatory tax form in Spain for tax residents to declare assets held outside Spain if they are above a certain value.

2. Who is required to file Modelo 720?

Any individual or entity that is a tax resident in Spain and holds assets abroad exceeding the reporting limits must file this declaration. When you move to Spain, you complete it the year after you become tax resident.

3. What are the declaration thresholds?

The Modelo 720 must be filed if the total value of assest in three categories exceeds €50,000. If previously declared, updates are required only if the value has increased or decreased by more than €20,000.

4. What are the assets that must be declared?

The foreign assets are in 3 categories. If the total value a category a category exceeds the threshold of €50,000, then all the assets in that category must be reported. The categories are:

>Bank accounts (current, savings, deposits, etc.)

>Investments and financial assets (shares, bonds, mutual funds, life insurance, personal pensions, annuities, etc.)

>Real estate (private property, commercial etc.

5. When is the deadline to submit Modelo 720?

The form must be submitted by March 31st of the year following the fiscal year being reported.

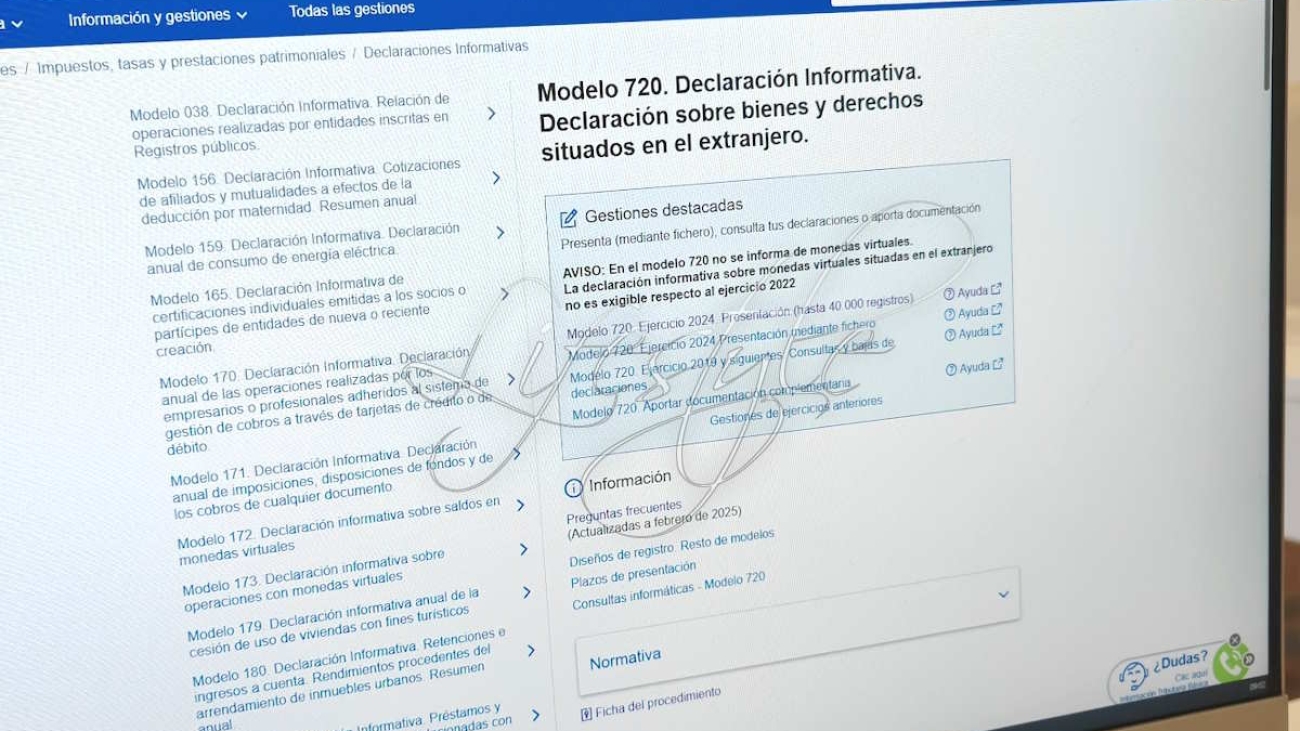

6. How is Modelo 720 filed?

It is submitted electronically through the website of the Agencia Tributaria (Spanish Tax Agency).

7. What happens if I don’t file Modelo 720 or file it incorrectly?

Failure to file or filing incorrect information can result a penalty. Previously these penalties were severe and disproportionate, however were succesfully challenged in the EU Court of Justice. The penalties that can be applied now for failing to file or misfiling are administrative.

For late or incorrect submissions, the basic penalties are now €200 for failing to submit the form or €150 for incorrect submissions.

8. What if I make a mistake in the declaration?

Yes, you can modify a submitted Modelo 720. Corrections must be made through an amended declaration (declaración complementaria) if errors are detected. Modifying a return could trigger a penalty for previously filing incorrect information or for late submission, so it’s important to get the retunrn right first time to avoid any fines.

9. Is Modelo 720 related to wealth tax?

No, Modelo 720 is purely an informative declaration and does not trigger wealth tax. However, assets reported may be considered in wealth tax calculations.

10. Do non-residents in Spain need to file Modelo 720?

No, only tax residents of Spain are required to file. Non-residents do not have this obligation.

11. Are cryptocurrency holdings abroad required to be declared in Modelo 720?

Cryptocurrencies are not included in Modelo 720, they are reported in a separate Modelo 721 filing.

12. Do I need to submit Modelo 720 every year?

No, you only need to submit it again if:

>The total value of any declared asset category increases or decreases by €20,000 or more

>You acquire new assets that push you over the €50,000 threshold

>You close or sell previously declared assets

13. How do I know if I am a tax resident in Spain?

You are considered a tax resident if:

>You spend more than 183 days in Spain in a calendar year

>Your primary economic interests are in Spain

>Your spouse and minor children reside in Spain

14. Can I be penalized for past non-declarations if I file Modelo 720 late?

While past penalties have been ruled disproportionate by the EU Court, the Spanish Tax Agency can still impose fines for general non-compliance and where tax fraud or evasion is found to have has taken place. The statute of limitations is four years for general cases, five years for tax offenses, and ten years for aggravated tax offenses.

15. Does filing the Modelo 720 mean that I need to pay taxes on declared assets?

No, the Modelo 720 is purely an informative declaration. However, if undeclared assets are discovered later and it is found that there has been tax evasion related to those assests, they could be subject to taxation and penalties.

11. What was European Court of Justice ruled on Modelo 720?

Yes. In January 2022, the European Court of Justice (ECJ) ruled that Spain’s excessive penalties for late or incorrect submissions were disproportionate and violated EU law. (Spain had been imposing fines of up to 150% of the undeclared asset, in many cases where the individual had acquired the assest quite legitimately before mobing to Spain!). The Spanish government has since revised the penalty structure, but the declaration remains mandatory.

12. Where do I file Modelo 720?

The online form is located in the Spanish Tax Agency (Agencia Tributaria) website. You need a digital certificate or Cl@ve to complete it, or you can have someone complete it on your behalf.

13. Can I get professional help to file Modelo 720?

Yes, there are many gestors, accountant and tax advisors that offer services to assist with filing Modelo 720 correctly to avoid errors and potential penalties.

15. How can I get assistance with filing Modelo 720?

The Spanish Tax Agency website has a FAQ’s section dedicated to the Modelo 720

We can also help you file your Modelo 720. Click here to request assistance.